Paytm Fastag KYC Update Online | How to Check Fastag KYC Status

Paytm Fastag KYC Update – after the new rule given by the government everyone is in the hustle to complete their KYC for Fastag, as after 31st January vehicles without KYC will be blocked. So here are simple and easy steps for Paytm Fastag KYC updating online and checking Fastag KYC status.

Paytm Fastag KYC Update

KYC-verified users on Paytm don’t need any kind of fasting KYC. Just make sure you have sufficient balance in your payment method.

How to Check Your Paytm KYC

1) open your Paytm app

2) Tap on your name on the up-left side. You’ll be able to see a scanner and your name on the top.

3) If your name shows a blue tick beside it, it means your KYC is completed.

Now if you’re not able to see the tick, it means your KYC isn’t completed, here’s how you can complete it

Paytm KYC Activation

Carefully follow the given steps to complete your KYC verification on the Paytm application:

- Open the Paytm mobile app and click on your profile picture in the top left of the home screen to go to the ‘Profile‘ section.

- Scroll down to the ‘Profile Settings’ section to view your account details and profile features/features.

- Your wallet status will appear as ‘Inactive’. Click ‘Activate Now’ to start the process.

- Click on ‘Complete your minimum KYC to activate wallet’ to proceed with the activation process.

- Once you complete the minimum KYC requirements, your Paytm Wallet will be operational with minimum monthly limits and minimum fees.

- You can upgrade your account to full KYC and get more benefits.

- Paytm accepts various documents like Aadhaar, Passport, and Voter ID for the KYC process.

- Paytm offers a simple KYC process that makes it easy for users to activate and update their wallets.

There are several options to complete your full KYC for Paytm, here are the best possible ways you can perform the full KYC procedure.

1) VIDEO KYC

- To start with the video KYC, type your Aadhar number on the page, and you’ll receive an OTP, make sure you’re using the number linked to your Aadhar card.

- After the verification of the Aadhar card, you have to give your basic details such as address, marital status, etc.

- The next process will be video KYC, you’ll receive a call where the executive will ask your DOB and current address.

- You are supposed to keep your PAN card with your video on.

- Once all the procedure is done, Paytm will give your identity verification and your ID will be made KYC verified.

Read more: How to Do KYC of Fastag, KYC for Fastag: Check if you haven’t completed it yet.

2) Visiting a Nearby KYC Center

- If you face any problem in completing the Video KYC process, you can visit the nearest KYC center for verification. Paytm offers a list of KYC centers based on location, which can be found under the ‘Visit Nearest KYC Store’ section.

3) KYC At Your Doorstep

- You can also apply for KYC verification at your doorstep, but this service costs Rs. 150 available in select cities only.

Paytm Fastag KYC Update Online

Paytm doesn’t need any KYC or bank linking for your fastag. It provides its users with hassle-free Fastag payments. You just have to make sure that you have sufficient balance in your added payment method.

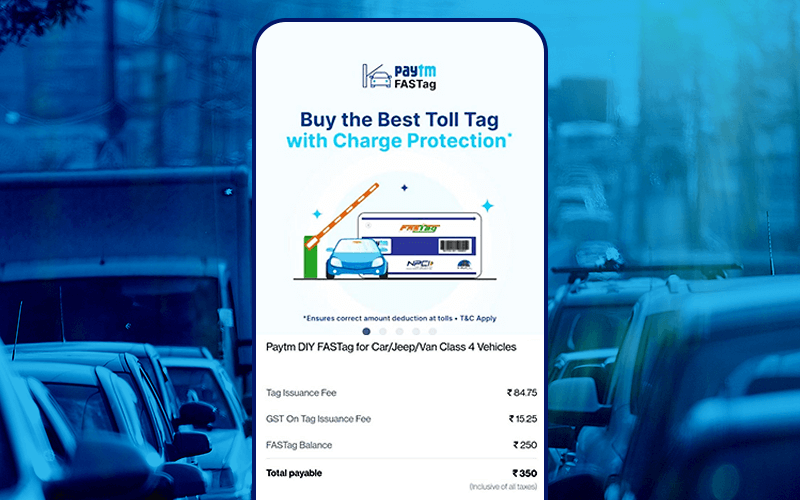

Here’s how you can buy the Paytm FASTAG

1) Search for Fastag on the Paytm app and select your preferred vehicle.

2) now you’ll be asked to submit the vehicle’s registration number and upload the RC.

3) Confirm your residential address and select the payment option from given.

4) And you’re successfully done with your Fastag buying.